Investing in Sustainability

Green Finance Framework

The Group has implemented a Chinachem Group Green Finance Framework (“the Framework”) to steer our Green Financing Transactions (“GFT”) in alignment with its strategic objectives and overarching vision. This Framework is aligned with the Green Bond Principles 2018, issued by the International Capital Market Association (“ICMA”), alongside the Green Loan Principles 2021, developed by the Loan Market Association (“LMA”), the Asia Pacific Loan Market Association (“APLMA”), and the Loan Syndications and Trading Association (“LSTA”).

The Framework facilitates fundraising through both bonds and loans, with proceeds allocated to Eligible Projects that provide environmental benefits. For each green finance transaction, the Group commits to adhere to principles regarding the utilisation of proceeds, the evaluation and selection of projects, the management of proceeds, and the provision of comprehensive reporting.

Allocation of Green Loan and Sustainability-Linked Loan Proceeds

|

Year Executed |

Category |

Project |

Currency |

Facility Amount (HKD) |

Maturity Date |

|

December 2023 |

Green Loan |

One New Street Square |

GBP |

0.8 billion |

December 2025 |

|

November 2023 |

Green Loan |

Construction of Kwai Chung Cold Storage Logistics Centre |

HKD |

8.8 billion (Share of the Group: 2.6 billion) |

November 2028 |

|

January 2023 |

Green Loan |

Non-Industrial Development at Tung Chung Town Lot No.45 |

HKD |

4.8 billion |

January 2028 |

|

June 2022 |

Sustainability-Linked Loan |

- |

HKD |

1 billion |

Subject to the Bank’s annual review |

|

January 2022 |

Green Loan |

Caroline Hill Road Commercial Project |

HKD |

13 billion (Share of the Group: 5.2 billion) |

January 2027 |

|

December 2021 |

Sustainability-Linked Loan |

- |

HKD |

1 billion |

December 2024 (Repaid in October 2024) |

|

November 2019 |

Green Loan |

Residential Development at Ho Man Tin Station Project Package Two Development |

HKD |

5.3 billion |

May 2025 |

Year Executed

December 2023

Category

Green Loan

Project

One New Street Square

Currency

GBP

Facility Amount (HKD)

0.8 billion

Maturity Date

December 2025

November 2023

Category

Green Loan

Project

Construction of Kwai Chung Cold Storage Logistics Centre

Currency

HKD

Facility Amount (HKD)

8.8 billion (Share of the Group: 2.6 billion)

Maturity Date

November 2028

January 2023

Category

Green Loan

Project

Non-Industrial Development at Tung Chung Town Lot No.45

Currency

HKD

Facility Amount (HKD)

4.8 billion

Maturity Date

January 2028

June 2022

Category

Sustainability-Linked Loan

Project

-

Currency

HKD

Facility Amount (HKD)

1 billion

Maturity Date

Subject to the Bank’s annual review

January 2022

Category

Green Loan

Project

Caroline Hill Road Commercial Project

Currency

HKD

Facility Amount (HKD)

13 billion (Share of the Group: 5.2 billion)

Maturity Date

January 2027

December 2021

Category

Sustainability-Linked Loan

Project

-

Currency

HKD

Facility Amount (HKD)

1 billion

Maturity Date

December 2024 (Repaid in October 2024)

November 2019

Category

Green Loan

Project

Residential Development at Ho Man Tin Station Project Package Two Development

Currency

HKD

Facility Amount (HKD)

5.3 billion

Maturity Date

May 2025

Case Study

Hong Kong’s First-ever 8.8 billion (HKD) Green Loan for Logistics Centre Development

The Group partners with ESR Group Limited to secure Hong Kong’s first 8.8 billion (HKD) green loan. This financing, one of the largest issued in 2023, supports the development of the Kwai Chung Cold Storage Logistics Centre, the largest cold storage facility built in Hong Kong in 20 years. By aligning with the Green Loan Principles, the partnership demonstrates a commitment to responsible investment practices.

The five-year committed green loan will support the construction of the centre, aiming to achieve green building certifications, including BEAM Plus New Building Gold and LEED Gold. The project will dedicate 30% of the site area to greenery, featuring a rooftop garden and a recycling irrigation water system. Moreover, Electric Vehicle (“EV”) charging points will be integrated into the car park.

Sustainable Investment Criteria

We recognise that prosperity encompasses more than just financial success; it also includes the welfare of our communities and the health of our planet. This perspective informs our investment strategy, as we adhere to a comprehensive set of ESG Due Diligence Guideline and ESG Investment Guidelines to ensure that our portfolio reflects our values and contributes to a more sustainable future. Additionally, prioritising sustainability enables us to develop a more resilient and long-lasting portfolio, which is likely to yield greater value over time and present lower risks compared to traditional investment approaches.

ESG Due Diligence Guideline

In the reporting year, the Group updated our guidelines to enhance the integration of Environmental, Social, and Governance (“ESG”) considerations into investment management activities, reinforcing CCG’s commitment to sustainable development and responsible investing. These guidelines now apply to conventional financial and startup funds, diversification investments, and the acquisition of existing building assets in Hong Kong, Mainland China, and overseas.

For real estate investment, key updates include a structured technical due diligence process which requires thorough screening and adherence to a Due Diligence Checklist. Acquisitions are limited to buildings that meet at least the second-highest rating in recognised green and wellness standards, while the carbon intensity of target assets will be assessed with reference to the CCG3050+ Carbon Reduction Roadmap or any subsequent updates.

Compliance records must be maintained, and justifications provided for any deviations from the guidelines, ensuring transparency and accountability in our sustainability initiatives and furthering CCG’s commitment to sustainability.

Case Study

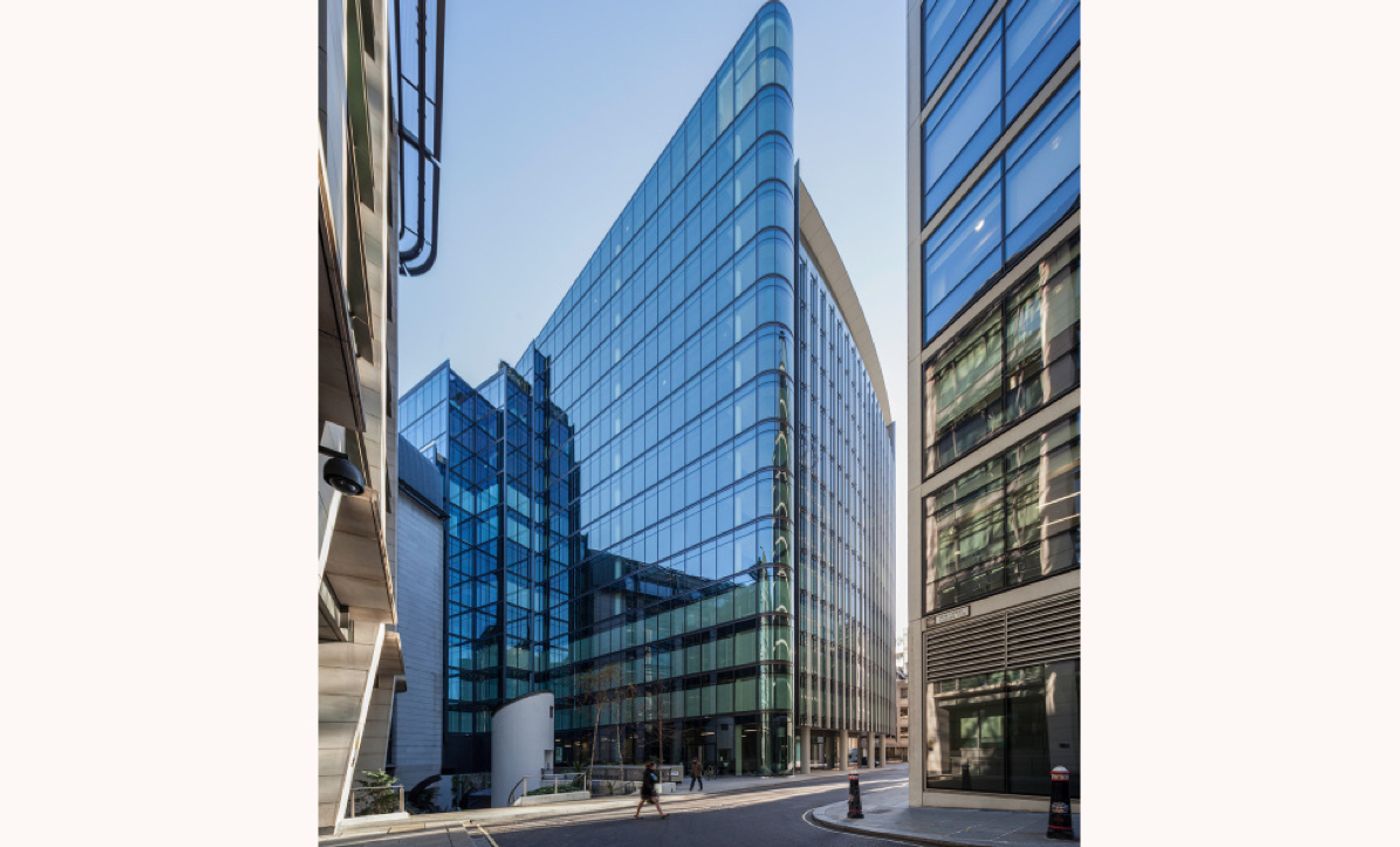

Enhancing Our Global Portfolio through Sustainable Property Acquisitions

The acquisition of Kaleidoscope and One New Street Square, two key properties in London, UK, in FY2022/23 not only marks a strategic entry into the overseas real estate market but also underscores our firm commitment to fostering a sustainable built environment on a global scale.

Kaleidoscope and One New Street Square have both been awarded a WELL “Gold” certification, with Kaleidoscope receiving an “Excellent” rating under the Building Research Establishment Environmental Assessment Method (“BREEAM”), while One New Street Square has achieved an “Outstanding” BREEAM rating. Notably, One New Street Square received the “Best Fit Out of Workplace” award at the BCO National Awards in 2019, which underscores its exceptional design and ESG credentials. This building is also the largest in the world to achieve dual certification with both BREEAM Outstanding and WELL Gold certifications, showcasing our commitment to sustainability.

The sustainability features of these buildings include advanced water and energy management systems, as well as a robust digital infrastructure at Kaleidoscope. In contrast, One New Street Square has been designed with nature in mind, surrounded by plentiful trees and an extensive vertical garden. Moreover, it recently received the “Test of Time” award at the BCO National Awards in 2024, recognising its ability to meet the evolving needs of tenants while maintaining its original design intentions. Together, these properties provide a green and health-conscious environment, allowing occupants to fully engage with sustainable living.

By ensuring our acquisitions meet stringent ESG criteria and the ESG Due Diligence Guideline, we are not only enhancing the quality of our overall investment portfolio but also reinforcing our commitment to sustainable development.

Sustainable Investment Guideline

To implement a responsible investment strategy, we aim to maintain an average MSCI ESG Rating of BBB or above for our investment portfolio. During our analysis, we thoroughly assess the ESG ratings of companies, ensuring that ESG performance is considered alongside financial indicators. We also prioritise the acquisition of sustainable bonds whenever they are available from the same issuer. Furthermore, we meticulously review the ESG reports of asset management firms associated with our fund investments, as well as any relevant ESG credentials held by asset managers during the selection process. Our goal is to identify and support companies that demonstrate strong ESG practices.

To further our commitment to sustainable investment, we have chosen to exclude sectors that are incompatible with our values. These sectors include:

In accordance with the ESG Due Diligence Guideline and ESG Investment Guidelines, we strive to develop a sustainable portfolio that not only delivers positive financial returns but also makes a significant contribution to society and the environment.